Another week, another rise in fixed mortgage rates. How high could they go?

The Canadian mortgage market has been completely overtaken by fixed rate hikes for yet another week.

Following the recent spike in Government of Canada bond yields, which are used to determine the price of fixed-rate mortgages, mortgage lenders, including the majority of the main banks, proceeded to raise their fixed mortgage rates.

Over the past week, a number of major banks, including BMO, CIBC, and RBC, increased their advertised rates by 15 to 40 basis points. One basis point is equal to 1/100th of a percentage point, or 0.01%.

Data from MortgageLogic.news shows that shorter 1- and 2-year periods saw some of the greatest swings. The typical deep discount rate for a 1-year term among national mortgage lenders has increased to 6.25% from 5.99% a week earlier. Additionally, posted 2-year rates at the major banks have increased by almost the same amount, currently average close to 6.40%.

Ron Butler of Butler Mortgage points out that bond yields are now up by over 100 basis points, or a full percentage point, from their March lows.

In previous weeks, rates with a 4-handle—that is, those in the 4% range—have largely disappeared. But the latest rounds of rate hikes are taking many fixed rates well into 6% and 7% territory.

Asked if 5-handle rates could be next to dry up, Butler said borrowers can expect 1- and 2-year rates in the 6% range, while 3- and 5-year rates should stay in the 5% range “for the time being.”

He adds that clients are continuing to express interest in both two and three-year terms.

Will rates continue to increase next week?

Butler believes that lenders and brokerages will continue to boost fixed rates next week, maybe by as much as 30 bps, in light of the spike in bond yields.

The next significant level of 4.00% is still in the 5-year yield’s sights now that it has breached 3.60%, according to Ryan Sims, a broker with TMG The Mortgage Group and a former investment banker.

“If we see a large drop today on the close, I think a lot of lenders will hold, but if we close up or even flat today, and next week is the same, then I think we could see some further fixed rate increases,” he told CMT.

“If we see the Canada 5-year bond hit the magical 4.00%, there is not a lot of resistance between 4.00% and 5.00%,” he added. “It’s not my prediction at all, but if we hit 4%, hold the 4%, and get any little bit of inflationary news, then it will be rocket fuel to the yield.”

Michael Gregory, Deputy Chief Economist at BMO Economics, notes that 2-year yields are up 43 bps from May’s average so far and are “poised to become the highest monthly mark in almost 15 years.”

He said the increase reflects “the prospects for a higher terminal policy rate and a ‘higher-for-longer’ theme to subsequent easing (presuming the economy steers clear of a deep recession).”

“Meanwhile, on both sides of the border, we look for the yield curve (2s-10s) to reach peak inversion for the cycle (on a monthly average basis) within the next month or two,” he added.

What’s driving the rate hikes?

The increase in Canadian bond yields followed recent rate increases by other central banks across the world and a spike in U.S. Treasury yields in reaction to Jerome Powell’s hawkish remarks.

Powell said in testimony before American legislators that tighter policy will be required. Fed Governor Michelle Bowman stated “additional policy rate increases” would be necessary to bring inflation under control on a different occasion.

Additionally, Powell stated last week that the Fed would only consider rate reduction once inflation significantly decreased.

“It will be appropriate to cut rates at such time as inflation is coming down really significantly, and again, we’re talking about a couple years out,” he said.

U.S. markets are now pricing in a higher chance of two additional FOMC rate hikes this year., and any moves south of the border inevitably have an impact on Canadian interest rates.

This week also saw rate hikes by the Swiss National Bank, the Bank of England and Norges Bank. The latter two surprised markets with larger-than-expected increases of 50 bps.

Taken all together, the latest rate commentary and central bank moves have heightened market concerns about global inflation as well as the economic impact of higher-than-expected policy rates.

The latest Bank of Canada rate forecasts

Those with a variable rate are also expected to feel more pain from rising rates, potentially as soon as the Bank of Canada‘s next policy meeting on July 12.

Markets are pricing in a nearly 70% chance of an additional quarter-point rate hike next month, with those odds rising to 100% by September. All eyes will be on May inflation and employment figures, which could sway the BoC decision either way.

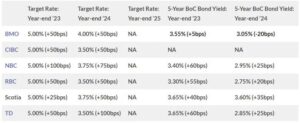

The following are the latest interest rate and bond yield forecasts from the Big 6 banks, with any changes from their previous forecasts in parenthesis.

Source: https://www.canadianmortgagetrends.com/2023/06/another-week-another-rise-in-fixed-mortgage-rates-how-much-higher-could-they-go/